December 7, 2011

Lefties Love the Static Quo!

California Gov. Edmund Gerald "Jerry" Brown, jr. (son of former California Gov. Edmund Gerald "Pat" Brown, sr.) is pushing hard for a big, punitive state income-tax hike on "the rich," meaning the top 1% -- who pay nearly 50% of California income tax.

New York Gov. Andrew Cuomo (son of former New York Gov. Mario Cuomo) just cut a deal to raise taxes an extra two percent (from 6.85% to 8.82%) on those earning $2 million per year or more.

And numerous other blue states are seeking to do the same... as is, of course, President Barack H. "Lucky Lefty" Obama (son of no one).

One thing all these economically challenged chief executives have in common is their inability -- or unwillingness -- to grok the idea of dynamic economic analysis, and their subsequent slavish devotion to static analysis. That is, they assume that a new tax policy will not itself alter people's tax-avoidance behavior. Or else they pretend to assume it, as it helps their duplicitous schemes; I lean towards the latter explanation.

Their real or feigned "reasoning" goes thus:

- We have a state income tax of 7% that brings in $10 billion.

- We have a budget shortfall of $2 billion.

- Therefore, all we need do is raise taxes to 8.4%; if 7% brings in $10 billion, then jacking it up by 20% of that 7% -- by 1.4% extra -- will surely bring in $12 billion.

- Problem solved! Q.E.D.

Leave aside for a moment the first obvious point: No such plan has ever or will ever allocate all the extra money to deficit reduction; even if it seems to do so and is actually written into the law, money is fungible... and the state legislature (or Congress) will simply increase other spending... thereby increasing the deficit by even more than it was reduced by revenue from the new tax. But we're not here to talk politics; let's just stick with the tax itself for a moment.

The syllogism above is a perfect gem of static analysis: The politicos argue (honestly or mendaciously) that if 7% raises $10 billion, then 8.4% will raise $12 billion. If we continue the argument, then a state income tax of 14% will raise $20 billion, 50% will raise $71 billion -- and if the state would only have the guts to raise its income tax to 100%, that would firehose a whopping $143 billion into the state coffers!!1!

Which points out (a) the absurdity of the naïve static hypothesis, and (b) the proper use of reductio ad absurdum.

It's clear to anyone with more than a couple neurons to rub together that any increase in tax rates will trigger people to engage in more tax-avoidance tactics. It's a no-brainer. And what socioeconomic group do you reckon is best equipped to legally avoid taxes? Yep, that's what I reckon, too: the rich.

For state income taxes, the absolute best tax-avoidance tactic is (drum roll) to move out of the high-tax state into a low- or no-tax state... of which there are plenty; they're called "red states." Until and unless Democrats begin requiring internal passports for travel -- any month now, I expect -- they can't stop the Evile Rich from fleeing California to repatriate in Nevada or Texas.

But beyond moving, the very, very successful also have the unique ability to restructure their revenue stream, shifting it, say, from ordinary income to capital gains, or from American sources to foreign sources, or to delay receipts until a more favorable tax situation presents itself. If need be, they can forgo salaries and such for years without feeling any pain, living off savings or just mooching off friends (who will expect reciprocity in their own time).

The ne plus ultras can engage in tax-reduction activities, taking advantage of "loopholes" that are, in reality, congressional subsidies to lure rich investors into otherwise unexciting ventures. The rich can get their friends to receive their income for a while, then pay it back later. And of course, the rich can afford legal beagles who are paid a hundred times as much as, and therefore are correspondingly cleverer than, the IRS's own pathetic, also-ran tax lawyers.

The ultra-rich are the very people that municipalities, counties, states, and even the feds are least able to reel back in state, should the designated victims decide they're being overtaxed. The Capitalists always win; in the long run, the invisible hand of the market beats the invisible foot of the government every time.

And if worse comes to worst, the little Monopoly guy can just buy a few more congressmen.

Ergo, since such surcharges on the rich are notoriously uncollectable, static economic analysis is as futile a gesture as passing a law declaring pi to be equal to 3.0 (which the state legislature of Indiana, I believe, nearly did); as futile as passing a law declaring that the United States will return to the carbon footprint it had in 1980. Trying to repeal the laws of economics is like trying to repeal entropy: You can make a good show of it for a geological microsecond; but in the end, you're left with nothing but a big bag of fully expanded hot air.

By contrast, those of us willing to use dynamic analysis -- where we assume that human beings will actually respond intelligently to stimuli -- then we already know what happens when states lower, rather than raise, their taxes, whether personal, business, or capital gains, as well as when states reduce regulations and defund the unions (including public-empoyee unions): Money, talent, genius, and especially people pour into the newly financially attractive state, the new free-trade zone; this in turn causes an economic sonic boom.

But don't expect any of that from elected liberals. I've long been convinced that they're neither stupid nor ignorant of economic laws; they just reject market reality and substitute their own, imposed by executive fiat.

That, in a nuthouse, is what Michael Barone means by calling Obamunism "gangster government."

Hatched by Dafydd on this day, December 7, 2011, at the time of 1:01 AM

Comments

The following hissed in response by: snochasr

so, if I may be so bold as to paraphrase your erudite exposition above, liberals are either stupid, or ignorant or crazy, at least on tax policy. My question for you is, what difference does it make?

The above hissed in response by: snochasr ![[TypeKey Profile Page]](http://biglizards.net/blog/nav-commenters.gif) at December 7, 2011 9:39 AM

at December 7, 2011 9:39 AM

The following hissed in response by: Dafydd ab Hugh

Snochasr:

You left out one option, which I believe to be the most likely: mendacious.

And it makes a big difference which explanation holds:

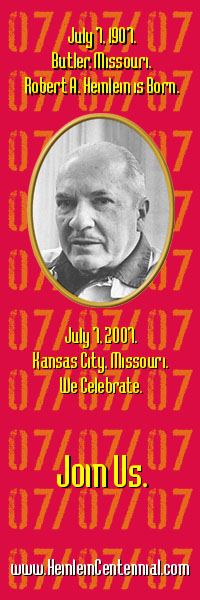

- If ignorant, they must be educated, à la Ronald Reagan and Robert Heinlein.

- If stupid, they must be converted, à la Michael Medved.

- If crazy, they must be sidelined and used as a bad example, à la Al Franken and Joe Biden.

But if they're mendacious, they must be fought with courage and vigor, à la Nancy "Moneybags" Pelosi, Harry "Pinky" Reid, Rahm "the Godfather" Emanuel, and not to forget Barack H. "Lucky Lefty" Obama.

And there's little time; we must sort them into proper categories and bustle, Shochasr.

Dafydd

The above hissed in response by: Dafydd ab Hugh ![[TypeKey Profile Page]](http://biglizards.net/blog/nav-commenters.gif) at December 7, 2011 11:50 AM

at December 7, 2011 11:50 AM

The following hissed in response by: snochasr

I appreciate that list of distinctions and solutions, but I fear I must quibble. First of all, I have always believed that "Ignorance can be cured by education, but stupidity is forever." And I believe that suggesting they are mendacious-- that they KNOW they are lying-- gives them too much credit. They are all too old to be ignorant and so they must be stupid.

Finally, there is such a thing as crazy like a fox, and these people manage to keep getting re-elected so unless you want to start classifying voters likewise, we need to find a way to actually "sideline" these puddin' heads.

My point was that their mental conditions do not make a difference to what they do and the kinds of government lunacy they promote. It may be what they say that separates them into your neat little mounds of madness, and from there they can and should be outcast. But how? Ah, there is the rub.

The above hissed in response by: snochasr ![[TypeKey Profile Page]](http://biglizards.net/blog/nav-commenters.gif) at December 8, 2011 7:36 AM

at December 8, 2011 7:36 AM

Post a comment

Thanks for hissing in, . Now you can slither in with a comment, o wise. (sign out)

(If you haven't hissed a comment here before, you may need to be approved by the site owner before your comment will appear. Until then, it won't appear on the entry. Hang loose; don't shed your skin!)© 2005-2013 by Dafydd ab Hugh - All Rights Reserved